Introduction

Venmo isn’t just for splitting restaurant bills or sending cash to friends—it’s also a payment platform for freelancers, sellers, small businesses, and regular people moving money for goods and services. With changing IRS guidelines and updated digital payment laws, staying compliant is critical. In 2025, reporting Venmo income to the IRS is no longer optional: anyone surpassing certain transaction thresholds or using Venmo for business is required to document their earnings with the correct tax forms.

This in-depth guide will cover exactly which Venmo tax documents you’ll receive or need to download, who has to file what, how to report digital payments, and what recent IRS rule changes mean for you. Advice is tailored for independent contractors, gig workers, casual sellers, and anyone using Venmo for more than personal reasons. We’ll break down common pitfalls, best practices, digital document access, top IRS questions to guarantee you’re tax-ready, penalty-free, and totally confident.

Venmo and IRS Reporting: The Essentials

Why Does Venmo Send Tax Forms?

Due to IRS regulations, Venmo and other payment platforms must report certain transactions to the government. If you receive payments for goods or services—or run a business using Venmo—you may be issued specific tax forms automatically.

IRS requirements as of 2025:

- Any payment app (including Venmo) must report a user’s business transactions that reach:

- Total of $600 or more in gross payments in a year

- Across any number of transactions (not just for $20K as in the old threshold)

- The reporting requirement does not apply to personal transfers/gifts between family and friends

Venmo’s Key Tax Forms Explained

IRS Form 1099-K

- The main form for reporting “third-party network transactions”

- Issued if you receive $600+ as payment for goods, services, or business—not for private/split payments

- Sent to both you and the IRS

When Will You Get a 1099-K?

- If your account receives $600 or more from goods/services in a calendar year—regardless of # of transactions

- If you designate payments as business-related in Venmo

- If others pay you via the “Goods and Services” option

What’s on a 1099-K?

- Gross total of all reportable transactions (not profits, just total received)

- Your taxpayer identification: SSN for individuals, EIN for business accounts

- The payor (Venmo’s) information

Table: Venmo Tax Reporting Scenarios

| Scenario | Do You Get a 1099-K? | What To Report? |

| You receive $700 for freelance work | Yes | All received |

| You get $1,200 in split dinners from friends | No | Not taxable |

| You sell $900 worth of items (as a side hustle) | Yes | All received |

| You’re paid by one business $600 (goods/services) | Yes | All received |

| Purely family money gifts ($2,000) | No | Not taxable |

How to Get and Use Your Venmo Tax Forms

- Electronic Delivery: Venmo typically issues digital copies of your 1099-K through your account portal and by email (if opted in). Paper forms may be mailed to your address on file.

- Accessing Forms: Log in > Settings > Tax Documents. Look for available forms for the most recent year.

- Double-check Info: Confirm your legal name, mailing address, and taxpayer ID (SSN or EIN) are correct in Venmo before January each year to avoid reporting errors.

Step-by-Step: What to Do When You Get a Venmo 1099-K

1. Review the Form Carefully

- Ensure the total matches your records for goods/services—contact Venmo support fast if there are discrepancies.

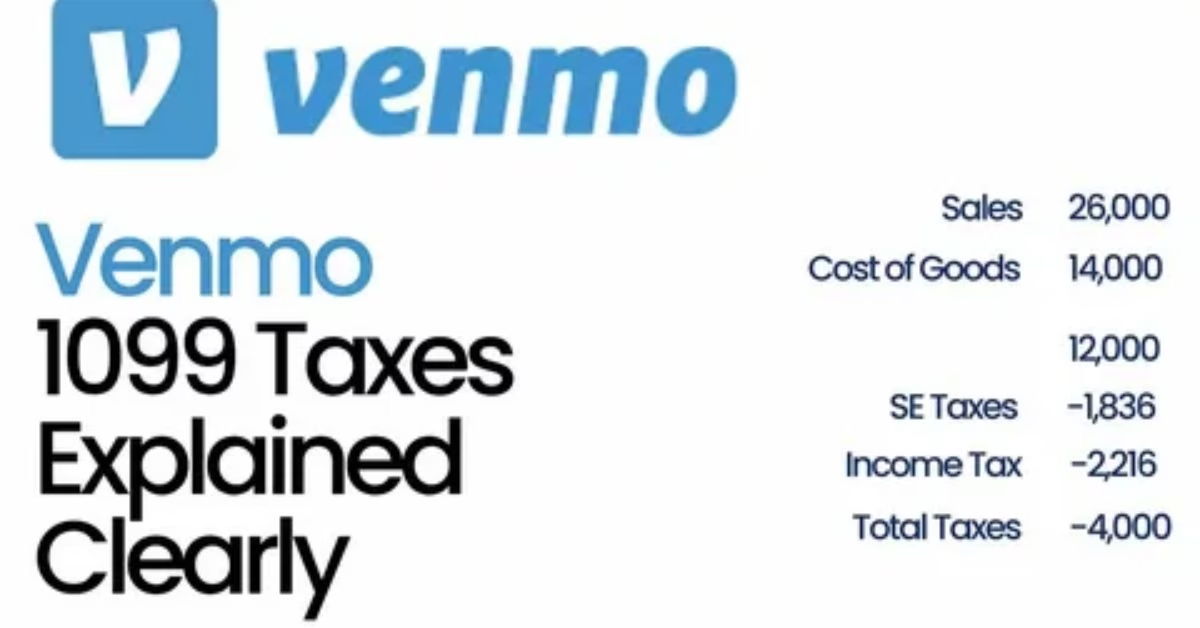

2. Add 1099-K Income to Your Tax Return

- Report the “gross payment amount” on your Schedule C (sole proprietors), business return, or as other self-employment/side income (if just a gig/part-time seller).

3. Deduct Expenses if Eligible

- Your 1099-K shows GROSS income; you can (and should) deduct legitimate business expenses, material costs, shipping, etc., when filing (save receipts).

4. File on Time

- Federal and most state deadlines are April 15–18 (verify for 2025).

- Filing late or omitting Venmo income can result in penalties and audits.

5. Retain Copies

- Save all documents and your final return for at least 3–7 years per IRS advice.

Venmo and Personal Transactions: Staying Safe

- Personal payments (friend/family splits) are NOT reported for taxes—unless misclassified as goods/services.

- When unsure, label transactions honestly (“gift,” “lunch split”) and avoid mixing business with personal in one account.

Pitfalls to Avoid with Venmo Tax Documents

- Mistaking personal payments for business: Only goods/services, freelance gigs, and sales count.

- Incorrect SSN/EIN: Can block or delay form delivery and create IRS confusion.

- Ignoring your 1099-K: Even if you “just” sell on the side, you must report all 1099-K income received.

- Missing paperless option: If you rely only on email, check spam and always download forms directly from Venmo’s web dashboard.

Table: Venmo Tax Document Do’s and Don’ts

| Do’s | Don’ts |

| Label business and personal clearly | Mix friends & business payments |

| Ensure SSN/EIN accuracy in app | Ignore emails from Venmo Tax |

| Download & check your 1099-K | Lose login before tax time |

| Track expenses for deductions | Assume the IRS won’t notice |

| File all reportable income | Miss tax deadlines |

What If You Don’t Get a 1099-K?

- If you met the $600 threshold but didn’t receive a form—contact Venmo support before tax day.

- Even without a form, you are still required to report all business income—the IRS gets reports from multiple sources.

Handling Tax on Venmo for Side Hustles, Rentals & More

- Marketplace sellers: Taxable on total goods/services payments received, subject to expense deduction.

- Landlords/rent via Venmo: Rental payments are taxable—Venmo is just the reporting method.

- Gig work/freelancing: Payments are treated as self-employment income for 1099-K and Schedule C.

FAQs

1. Will Venmo send me a 1099-K for 2025?

Yes, if you receive $600 or more in goods/services payments in the calendar year, Venmo must issue you (and the IRS) a 1099-K.

2. What if I only use Venmo for friends and family?

These transactions aren’t reported to the IRS and you won’t get a tax form unless you misclassify a business payment.

3. How do I get my Venmo 1099-K?

Access it via your Venmo account (Settings > Tax Documents), check your email, or contact support for assistance.

4. Do I report gross or net Venmo income on my taxes?

Report the full gross amount shown on 1099-K, but deduct eligible expenses/materials on your return.

5. What happens if my information is wrong on the tax form?

Update your details in Venmo, correct errors promptly, and resolve issues before filing—contact support if necessary.

Conclusion

Venmo tax forms play an essential role in digital money management for millions of Americans in 2025. If you earn income through the platform—no matter how small—you’re likely to receive a 1099-K and must report it to the IRS. Stay organized: check account info each January, track your income and expenses, keep your records, and follow IRS deadlines to avoid penalties.

With the right practices, Venmo is both a powerful money tool and a compliant part of your tax routine. For more tech tips and app reviews, check out Fletchapp.com to stay ahead in the world of technology!