Introduction

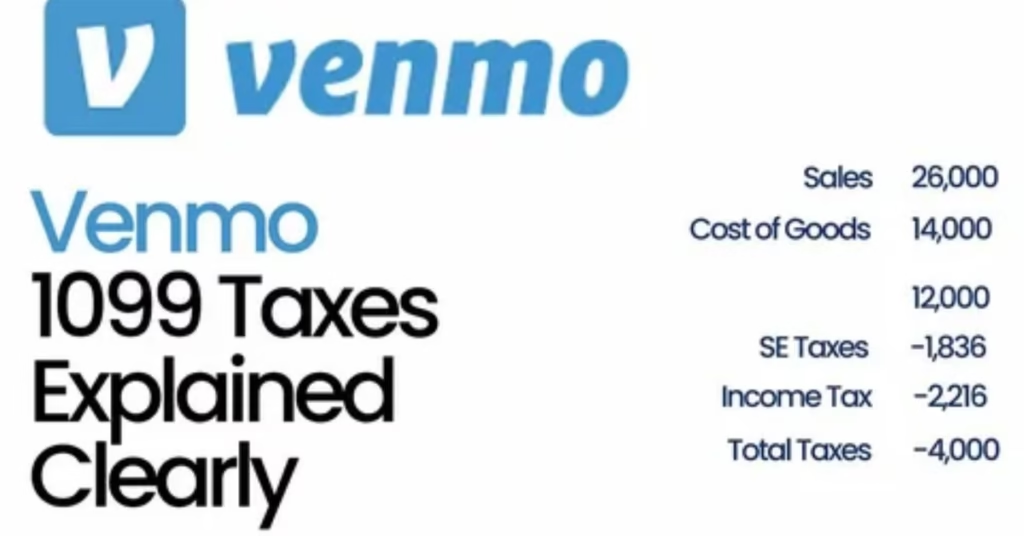

Millions of people in the USA now use Venmo to get paid for side hustles, freelance work, and small business sales—but most still aren’t sure how that money is treated for taxes. Is it okay to use a personal Venmo account for business payments? Do you only owe tax if you receive a 1099‑K form, or does the old 600‑dollar rule still matter? Recent IRS and reporting changes have created even more confusion, especially around when Venmo has to send a 1099‑K and when you still have to self‑report income anyway.

On the other hand, pure personal transfers—like splitting rent, getting reimbursed for pizza, or receiving a birthday gift—usually are not taxable. In this 2026 guide, you’ll clearly see the difference between personal and business payments on Venmo, how current 1099‑K thresholds actually work, and what the IRS really expects you to report—so you can stay compliant without overpaying on your taxes.

Why Venmo Payments Matter for Your US Taxes in 2026

Venmo is just a payment method; the IRS taxes the underlying activity, not the app. If you get paid on Venmo for goods or services—like freelance jobs, tutoring, digital products, or reselling items—that money is business income and is generally taxable, whether or not you receive a form from Venmo. On the other hand, pure personal transfers—like splitting rent, getting reimbursed for pizza, or receiving a birthday gift—usually are not taxable.

Because so many people now blur personal and business use on the same Venmo account, it’s easy to lose track of which payments are income and which are not. That confusion can lead to under‑reporting income (risking penalties) or over‑reporting (paying too much tax). Understanding how Venmo labels and reports transactions helps you avoid both mistakes in 2026.

The Difference Between Personal and Business Payments on Venmo

Venmo offers two basic ways to use the app: a personal account (for friends and family) and a business profile or business‑type use (for selling goods or services). Even on a personal account, you and your customers can mark certain payments as “goods and services,” which Venmo treats as business transactions.

Personal payments usually look like:

- Splitting rent, utilities, or a restaurant bill.

- Paying a friend back for concert tickets.

- Sending a holiday or birthday gift.

Business or income‑type payments usually look like:

- Getting paid for freelance design, writing, or consulting.

- Being paid for items you resell, such as clothing or electronics.

- Receiving money for services like babysitting, tutoring, or home repairs.

If you have a Venmo business profile, Venmo assumes those payments are for business, so they are more clearly in the “income” bucket for tax purposes.

How IRS Form 1099‑K Works With Venmo

Form 1099‑K is an information form that payment apps and marketplaces must send when your business‑related payments cross specific thresholds. For Venmo, the key points are:

- Venmo issues a 1099‑K only for payments received for goods and services, not for pure friends‑and‑family payments.

- For the 2025 calendar year (affecting 2026 filing), Venmo and PayPal issue 1099‑K at the federal level when your goods‑and‑services payments exceed 20,000 dollars and 200 separate transactions in a year.

- Some states have much lower thresholds, in some cases as low as 600 dollars, which can trigger a state‑level 1099‑K even when you don’t hit the federal level.

If you cross these thresholds, Venmo is required to send you and the IRS a 1099‑K summarizing your reportable payments. But even if you do not receive a 1099‑K, the IRS still expects you to report all taxable income from your Venmo activity on your tax return.

The “600‑Dollar Rule” Explained Simply for Venmo Users

You may have heard that “anything over 600 dollars on Venmo gets taxed,” which is only partly true and heavily misunderstood. Originally, there was a plan to lower the 1099‑K reporting threshold to 600 dollars, but legislation and IRS decisions have changed timing and thresholds several times.

The important practical points for 2026 are:

- The 1099‑K reporting threshold is currently at 20,000 dollars and 200 transactions at the federal level for Venmo and similar apps.

- Some states use different thresholds, and a few still treat 600 dollars of reportable transactions as enough to trigger a state 1099‑K.

- The taxability of income does not start at 600 dollars; legally, even 10 dollars of business income is taxable, regardless of whether you receive a form.

So the “600‑dollar rule” is about when a platform must send a particular form, not when your income becomes taxable. You are responsible for reporting income even below any form threshold.

Which Venmo Payments Count as Taxable Income (With Examples)

Any payment you receive through Venmo in exchange for goods, services, or business activity generally counts as taxable income, just as if you had been paid by cash or check. Examples include:

- A client paying you 500 dollars for freelance web design.

- Multiple customers paying you for items you resell, like shoes or electronics.

- Students paying you for tutoring sessions.

- People paying you for rides, cleaning, or repair services.

Whether the income is a main job, side hustle, gig work, or a one‑off project, the IRS treats it as taxable if it’s payment for work or products. Venmo’s role is to move the money; your responsibility is to track and report it correctly.

Which Venmo Transfers Are Usually Not Taxable

Not all money that hits your Venmo balance is taxable. Purely personal transfers do not usually need to be reported as income. Examples that typically are not taxable include:

- Your roommate sending you 300 dollars as their share of the rent you already paid.

- Friends reimbursing you for dinner or event tickets you covered.

- A relative sending you a birthday or holiday gift.

- Transferring your own money between accounts, such as from your Venmo to your bank or vice versa.

However, if you mix personal and business payments and use vague descriptions, it can become hard to prove which are which. Good labeling and record‑keeping are your best protections if questions ever come up.

Freelancers, Side Hustles, and Small Businesses Using Venmo

For freelancers, side hustlers, and small business owners, Venmo can be a convenient way to get paid—but it comes with tax responsibilities. If you consistently receive payments for work, you are likely considered self‑employed for that income and must report it on a Schedule C (or similar form) with your federal return.

Best practices for business‑type Venmo users include:

- Using clear descriptions such as “Logo design for Client A – March 2026.”

- Encouraging customers to mark the transaction as “goods and services” when appropriate.

- Keeping digital invoices, receipts, and messages that show what each payment was for.

- Considering a Venmo business profile so your business income is separated in the app.

You can also typically deduct legitimate business expenses (like software, equipment, or advertising) against your Venmo income, which can reduce your tax bill.

How to Export Venmo Transactions and Track Your Income

To prepare for tax time, you need a clear record of which Venmo transactions were business income and which were personal. Venmo allows you to review and, in some cases, download or export transaction history, which you can then categorize.

A simple workflow for 2026 is:

- At least once a month, review your Venmo activity and label each payment as business or personal in a spreadsheet or accounting app.

- For business payments, note who paid you, what it was for, and the date and amount.

- Keep copies of invoices, order confirmations, or DMs that show the work or product sold.

- At year‑end, total your business payments and compare them to any 1099‑K or other forms you receive.

This makes filing your taxes much easier and gives you backup documentation if the IRS or a tax preparer ever has questions.

What Happens If You Don’t Report Venmo Income to the IRS

If you fail to report taxable income you received through Venmo, you could face back taxes, penalties, and interest if the IRS later discovers the omission. The risk is higher if Venmo or other platforms file 1099‑Ks or other forms that show your income, because the IRS systems match those forms against your tax return.

Even if you do not receive any form, you are still legally required to report your income. If the IRS audits you and finds unreported business activity, they can assess additional tax plus failure‑to‑file and accuracy penalties. Keeping honest, clear records and reporting your Venmo income from the start is almost always cheaper and less stressful than dealing with problems later.

When You Should Talk to a Tax Professional About Venmo

While many simple situations can be handled with tax software and basic guidance, it’s smart to talk to a tax professional if:

- You receive a 1099‑K, 1099‑NEC, or multiple forms related to Venmo payments.

- You run a side business with significant Venmo revenue and expenses.

- You operate in multiple states or a state with special 1099‑K thresholds.

- You are unsure how to separate personal and business payments that are mixed together.

A tax professional can help you interpret forms, set up better record‑keeping, and legally reduce your tax bill using allowable deductions and credits.

Quick Checklist: Venmo Business vs Personal for 2026

Use this checklist to keep your Venmo tax‑ready:

- Decide whether you mainly use Venmo for personal, business, or both.

- Clearly label business‑related payments in your descriptions.

- Separate purely personal transfers (rent splits, gifts, reimbursements).

- Regularly export or review your Venmo history and track income in a spreadsheet or app.

- Watch your total goods‑and‑services payments to see if you approach 20,000 dollars and 200 transactions or state‑level thresholds.

- Report all business income on your tax return, even without a 1099‑K.

- Consider consulting a tax pro if your Venmo income is significant or complex.

Following these steps will keep your Venmo usage much cleaner from a tax point of view.

FAQs:

Q. Do I have to pay taxes on money received through Venmo?

You generally pay taxes on money received through Venmo if it is payment for goods or services—such as freelance work, side gigs, or business sales. Personal payments like gifts, reimbursements, or shared expenses are typically not taxable, but you must keep good records to show the difference.

Q. Do I owe tax if I don’t get a 1099‑K from Venmo?

Yes. You must report all taxable business income, even if you do not receive a 1099‑K or any other form. The thresholds only control when Venmo is required to send a form, not when your income becomes taxable.

Q. What is the difference between a Venmo personal account and a business profile for taxes?

With a business profile, Venmo generally treats your payments as business transactions and may apply business fees and reporting rules. On a personal account, only payments marked as goods and services count toward 1099‑K thresholds, but income is still taxable if it is for work or sales.

Q. Will Venmo report my personal transfers to the IRS?

Venmo’s 1099‑K reporting requirements apply to payments for goods and services, not to friends‑and‑family personal transfers like gifts or reimbursements. However, if you mislabel business payments as personal or mix them together, it can create confusion and potential risk at tax time.

Q. Does the 600‑dollar rule mean I only pay tax above 600 dollars?

No. The 600‑dollar figure relates to certain reporting thresholds, not when income becomes taxable. Legally, all business income should be reported, even if it is less than 600 dollars or you receive no forms.

Q. How should I track Venmo income for my side hustle?

Export or review your Venmo transactions regularly, label each payment as business or personal, keep receipts and invoices, and total your business payments for the year. You can use a spreadsheet or accounting tool to organize this information for your tax return.

Q. Can I deduct expenses against my Venmo income?

Yes, if you are self‑employed or running a business, you can usually deduct ordinary and necessary business expenses (such as supplies, software, or marketing) against your Venmo income. This reduces your taxable profit, but you must keep good records of those expenses.

Conclusion

In 2026, the key to handling Venmo taxes is understanding that the app itself doesn’t create tax rules—the nature of your payments does. Business and side‑hustle income received through Venmo is taxable whether or not you cross a 1099‑K threshold, while true personal transfers generally are not.

By clearly separating business and personal payments, tracking your income, watching the current 1099‑K rules, and getting professional help when needed, you can use Venmo confidently without worrying about unexpected tax problems later. For more tech tips and app reviews, check out Fletchapp.com to stay ahead in the world of technology!