Introduction

Wondering how to add money to Venmo for quick and hassle-free payments? You’re not alone. With over 90 million users in 2025, Venmo is a trusted app for splitting bills, paying friends, or shopping online at retailers that accept PayPal checkout. Adding funds to your Venmo balance simplifies transactions, making them smoother, faster, and easier to track. Whether you’re new to the app or a seasoned user, this post has you covered.

If you’re asking, “How do I add money to Venmo?” or “How do you add money to Venmo?” we’ll break down every method in detail. From using the mobile app for instant transfers to funding your account via desktop or even adding cash at stores like CVS, we’ll show you how to add money on Venmo with confidence. Let’s get started with clear, step-by-step instructions to keep your Venmo balance ready for action!

Why Add Money to Your Venmo Account?

Adding funds to your Venmo balance simplifies your financial life. Instead of pulling money from your bank account or card for every transaction, a pre-funded balance lets you pay instantly. This is especially handy for splitting dinner bills, sending gifts, or making online purchases at retailers that accept Venmo via PayPal checkout. Plus, it helps you keep track of your spending in one place.

If you’re wondering how to add money to my Venmo account for these benefits, we’ll walk you through the process step by step. But first, let’s cover what you need to get started.

Prerequisites for Adding Money to Venmo

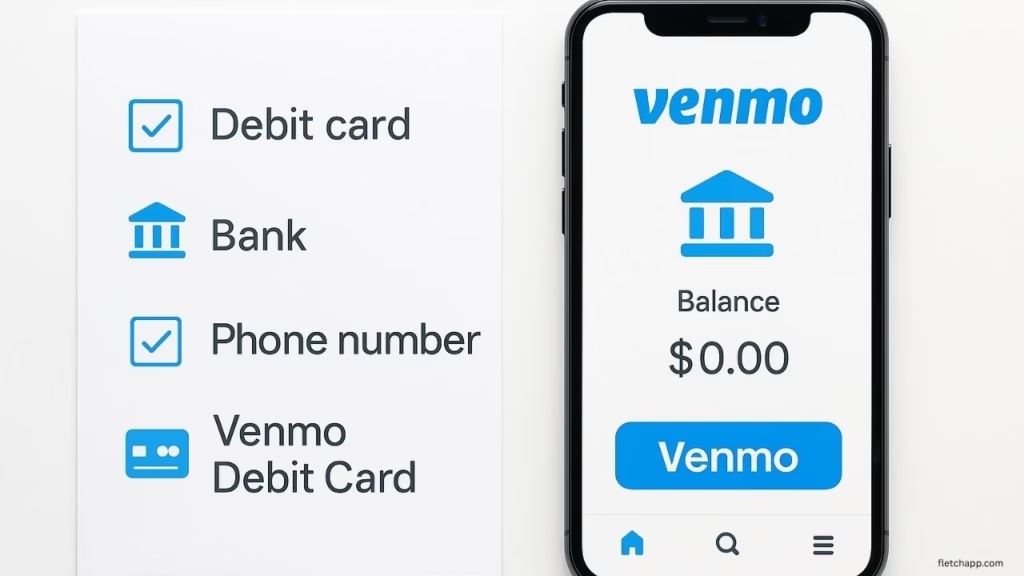

Before you learn how to add money to Venmo account, make sure you have the following:

- A Venmo account linked to a U.S. bank account, debit card, or credit card. Venmo only works with U.S.-based accounts, so international cards won’t work.

- A Venmo debit card (optional but required for direct balance top-ups). Without it, you can still send payments directly from a linked account, but adding money to your Venmo balance is limited.

- The Venmo mobile app (available on iOS or Android). Most funding options are app-based, as the desktop site has limited features.

- A verified phone number for security checks, especially for desktop transfers.

If you don’t have a Venmo debit card, don’t worry—you can still fund payments directly or use the desktop method to add funds. However, for the easiest way to add money to Venmo balance, applying for the Venmo debit card is a game-changer. Now, let’s explore the different methods to add money in Venmo.

Method 1: How to Add Money to Venmo via the Mobile App (With Venmo Debit Card)

If you have a Venmo debit card, how to add money to Venmo instantly is straightforward using the mobile app. This method is perfect for quick top-ups, especially if you need funds right away. Here’s how to do it:

- Open the Venmo app on your iOS or Android device. Make sure it’s updated to the latest version for a smooth experience.

- Tap the Me tab in the bottom-right corner to access your profile.

- Go to Wallet and select Manage Balance from the menu.

- Tap Add Money to start the process.

- Enter the amount you want to transfer. Venmo typically allows $10–$1,500 per安全性 transaction, but check your account limits.

- Choose your funding source. Select your linked bank account or debit card. Credit cards can’t be used to add money to your balance, only for direct payments.

- Confirm the details and tap Add to complete the transfer.

Processing Time: If you use a debit card, the transfer is instant, so you can start using the funds right away. Bank account transfers, however, take 3–5 business days to process. If you’re wondering how to add money to my Venmo account quickly, the debit card option is your best bet.

Pro Tip: Double-check that your Venmo debit card is linked to a bank account with sufficient funds to avoid declined transactions. Also, keep an eye on your app notifications for confirmation of the transfer.

Method 2: How to Add Money to Venmo via Desktop (Without Venmo Debit Card)

Don’t have a Venmo debit card? No problem. You can still learn how to add money to Venmo account using the desktop website, though it’s slightly less convenient. This method works best for bank account transfers. Here’s the step-by-step process:

- Visit venmo.com in your web browser and log in with your credentials.

- Enter venmo.com/addfunds directly in your browser’s address bar. This takes you to the funding page.

- Type the amount you want to add to your Venmo balance. Amounts typically range from $10 to $1,500, depending on your account limits.

- Select your linked bank account as the funding source. Debit or credit cards aren’t supported for this method.

- Enter the verification code sent to your registered phone number for security.

- Click Confirm & Add Funds to submit the request.

Processing Time: Expect funds to appear in your Venmo balance within 3–5 business days. Unlike the app’s debit card option, there’s no instant transfer available here. If you’re asking how do I add money to my Venmo account without a debit card, this method is reliable but requires patience.

Pro Tip: Use a secure, private Wi-Fi connection when accessing the desktop site to protect your account details. If you encounter issues, verify your bank account is linked correctly in the Venmo app.

Method 3: How to Add Cash to Venmo at Retail Stores

For those who prefer cash, Venmo offers a convenient way to add money to Venmo at participating retail stores like CVS, Walgreens, or 7-Eleven. This method is ideal if you don’t have a bank account or debit card linked. Here’s how to add money to Venmo balance with cash:

- Open the Venmo app and go to the Me tab, then tap Wallet.

- Select Manage Balance and choose Add Cash at Store.

- Pick a retailer from the list of participating stores. Venmo will show nearby locations based on your device’s location.

- Generate a barcode in the app. This barcode is unique to your transaction.

- Visit the store and present the barcode at the checkout counter.

- Pay the cash amount you want to add, plus any applicable fees. The cashier will scan the barcode and process the deposit.

Processing Time: Cash deposits are typically instant or take up to 1 hour, depending on the retailer. If you’re wondering how to add money to Venmo instantly without a debit card, this is a great option, though fees apply.

Fees: Retailers often charge a service fee, usually $3–$5 per transaction. Check the Venmo app for exact fees at your chosen store.

Pro Tip: Save the transaction receipt until the funds appear in your Venmo balance, as it can help resolve any issues with the deposit. Also, confirm the store’s hours, as some locations may have limited cashier availability.

Fees to Watch Out For

When figuring out how to add money in Venmo, it’s important to understand the potential costs. Here’s a breakdown of fees for each method:

- Debit/Credit Card (App Only): Adding money with a debit card is free and instant, but using a credit card for direct payments (not balance top-ups) incurs a 3% fee per transaction. If you’re asking how do you add money to Venmo without fees, stick to debit cards for instant transfers.

- Bank Account: Standard bank transfers (3–5 days) are free, whether done via the app or desktop. However, instant bank transfers (available only for payments, not balance top-ups) carry a 1.75% fee, with a minimum of $0.25 and a maximum of $25.

- Retail Cash Deposits: Fees vary by store, typically $3–$5 per deposit. Always check the app for specific costs before heading to the store.

To save money, opt for standard bank transfers or debit card top-ups when possible. If you need to add money to Venmo instantly, weigh the convenience of cash deposits against the retailer fees.

| Method | Fee | Processing Time |

|---|---|---|

| Debit Card (App) | Free (instant) | Instant |

| Credit Card (Payments) | 3% per transaction | Instant |

| Bank Account (Standard) | Free | 3–5 business days |

| Bank Account (Instant) | 1.75% ($0.25–$25) | Instant (payments only) |

| Retail Cash Deposit | $3–$5 (varies by store) | Instant or up to 1 hour |

Tips for Managing Your Venmo Balance

Once you’ve mastered how to add money to Venmo account, these tips will help you manage your funds effectively:

- Verify Bank Details: Before adding money, confirm that your linked bank account or debit card details are correct. Incorrect information can lead to failed transfers or delays.

- Use Instant Transfers Sparingly: While instant transfers are convenient, their fees can add up. Plan ahead and use standard transfers for non-urgent needs to save money.

- Monitor Your Balance: Keep a small amount in your Venmo balance for quick payments, but move excess funds to your bank account. Venmo balances are not FDIC-insured unless you use Direct Deposit, so don’t store large sums long-term.

- Stay Secure: Protect your account by enabling two-factor authentication in the Venmo app’s settings. Also, review your privacy settings to control who sees your transactions.

- Set Up Notifications: Turn on app notifications to get real-time updates on transfers, deposits, and account activity. This helps you stay on top of your balance.

By following these tips, you can make the most of your Venmo account while keeping your funds safe and accessible.

Troubleshooting Common Issues

Sometimes, things don’t go as planned when you try to add money to Venmo. Here are solutions to common problems:

- Transfer Delays: If funds don’t appear in your balance, verify that your bank account is linked and has sufficient funds. For bank transfers, wait 3–5 business days. If the issue persists, contact Venmo support at support@venmo.com or through the app’s Help section.

- Declined Transactions: This usually happens if your linked account or card lacks sufficient funds. Check your bank balance or try a different funding source. Also, ensure your Venmo account is verified with a valid phone number.

- App Errors: If the Venmo app crashes or shows errors, update it to the latest version from the App Store or Google Play. Alternatively, try a different device or clear the app’s cache in your phone’s settings.

- Retail Deposit Issues: If a cash deposit doesn’t show up, check your transaction receipt and confirm the barcode was scanned correctly. Contact the retailer or Venmo support with your receipt details.

- Account Limits: Venmo imposes weekly limits on transfers (e.g., $1,500 for balance top-ups). If you hit a limit, wait until the next week or contact Venmo to review your account.

If you’re still stuck, Venmo’s Help Center (accessible via the app or venmo.com) has detailed FAQs. You can also reach out to Fletch App for general app-related advice.

Why Use Venmo for Payments?

Venmo’s popularity stems from its social and practical features. You can split bills with friends, add emojis to payments, or share transaction notes (e.g., “Pizza night 🍕”). It’s perfect for personal transactions like paying roommates or sending birthday cash. Plus, Venmo is accepted at millions of online and in-store retailers through PayPal checkout, making it versatile for shopping.

For small businesses, Venmo offers a simple way to accept payments without complex setups. With over 90 million users in 2025, it’s a trusted platform for quick, secure transactions. If you’re learning how to add money to my Venmo account to streamline payments, Venmo’s ease of use and wide acceptance make it a top choice.

Advanced Tips for Venmo Users

To take your Venmo experience to the next level, try these advanced strategies:

- Link Multiple Funding Sources: Add both a bank account and a debit card to your Venmo account. This gives you flexibility to switch between instant and standard transfers based on your needs.

- Use Venmo for Online Shopping: Look for retailers that accept Venmo at checkout, especially those integrated with PayPal. This lets you use your balance for purchases without sharing card details.

- Set Up Direct Deposit: If you receive regular payments (e.g., paychecks), consider Venmo’s Direct Deposit feature. It’s FDIC-insured and lets you add money to your balance automatically.

- Track Spending with Labels: Add notes to your transactions to categorize spending (e.g., “Groceries,” “Rent”). This makes it easier to budget and track expenses.

- Explore Venmo Credit Card: If you qualify, the Venmo credit card offers cashback rewards and syncs with your Venmo balance, making it easier to manage funds.

These tips help you maximize Venmo’s features while keeping your account organized and secure.

Security Best Practices for Venmo

When learning how to add money to Venmo, security is a top priority. Here are key steps to protect your account:

- Enable PIN or Biometric Login: Set up a PIN or use fingerprint/face ID in the Venmo app to prevent unauthorized access.

- Review Transaction Privacy: By default, Venmo transactions are public. Go to Settings > Privacy and set transactions to private or friends-only to limit visibility.

- Avoid Public Wi-Fi: When adding money or making payments, use a secure, private network to protect your data.

- Monitor Account Activity: Regularly check your transaction history in the app. If you spot suspicious activity, freeze your account immediately via Settings > Security.

- Beware of Scams: Never send money to unverified users or respond to unsolicited payment requests. Venmo’s Help Center has a dedicated section on avoiding scams.

For more ways to secure your apps, visit Fletch App for expert tips on staying safe online.

Comparing Venmo to Other Payment Apps

If you’re deciding whether Venmo is the best platform for you, here’s how it stacks up against competitors like Cash App and PayPal:

| Feature | Venmo | Cash App | PayPal |

|---|---|---|---|

| Balance Top-Up | Debit card, bank, cash | Debit card, bank, cash | Bank, PayPal Cash |

| Instant Transfer Fee | 1.75% ($0.25–$25) | 0.5%–1.75% ($0.25 min) | 1% ($0.25–$10) |

| Social Features | Bill splitting, emojis | Limited social features | Limited social features |

| Retailer Acceptance | PayPal checkout, select stores | Select stores, Bitcoin support | Wide online/in-store support |

| Security | 2FA, encryption | 2FA, encryption | 2FA, encryption, buyer protection |

Venmo shines for social payments and ease of use, but PayPal offers broader retailer acceptance, and Cash App supports Bitcoin. Choose Venmo if you prioritize how to add money to Venmo for quick, social transactions.

Frequently Asked Questions About How to Add Money to Venmo

1. How do I add money to my Venmo account?

To add money to Venmo, open the app, tap Me, go to Wallet, and select Manage Balance. Tap Add Money, enter the amount, pick a linked debit card or bank account, and confirm. Debit transfers are instant; bank transfers take 3–5 days.

2. Can you load cash to Venmo at CVS?

Yes, load cash at CVS. In the Venmo app, go to Me > Wallet > Manage Balance, select Add Cash at Store, and generate a barcode. Show it at CVS checkout, pay cash plus a $3–$5 fee, and funds appear instantly or within an hour.

3. What stores can I add cash to Venmo?

Stores like CVS, Walgreens, 7-Eleven, and some Dollar General locations allow cash deposits. In the app, select Add Cash at Store under Manage Balance to find nearby stores for how to add money to Venmo. Fees are usually $3–$5.

4. Where is the add or transfer button on Venmo?

Find the Add or Transfer button in the app under Me > Wallet > Manage Balance. Tap it to add money to Venmo balance using a debit card or bank account. It may not show without a linked debit card.

5. Why does my Venmo not have an add money option?

If the Add Money option is missing, you may lack a Venmo debit card or verified bank account. Add a bank account in Settings > Payment Methods or apply for a debit card to enable how to add money to Venmo account.

6. How do I add money to Venmo from Cash App?

Venmo doesn’t directly accept Cash App transfers. Link the same bank account to both apps, move funds from Cash App to your bank, then add money to Venmo via Manage Balance in the app.

7. How to add money to Venmo instantly?

Use a Venmo debit card. Go to Me > Wallet > Manage Balance, tap Add Money, select your debit card, and confirm. Funds are available instantly for how to add money to Venmo instantly.

8. Can I add money to Venmo without a bank account?

Yes, add cash at stores like CVS. In the app, select Add Cash at Store, generate a barcode, and pay at checkout to add money to Venmo balance without a bank account.

9. Is there a fee to add money to Venmo?

Debit card transfers are free and instant. Bank transfers (3–5 days) are free. Retail cash deposits cost $3–$5. Credit cards can’t add money to Venmo directly but have a 3% fee for payments.

10. What’s the limit for adding money to Venmo?

Weekly limits for how to add money on Venmo are typically $1,500, varying by account. Check your limit in Settings > Payment Methods.

Conclusion

Now that you know how to add money to Venmo, you’re ready to streamline your payments. Whether you use the mobile app for instant debit card transfers, the desktop site for bank transfers, or cash deposits at retail stores, Venmo makes it easy to keep your balance funded.

For the fastest results, get a Venmo debit card and follow the app steps to add money to Venmo instantly. Have a favorite Venmo tip or question? Share it in the comments below, or explore more app posts on Fletch App to stay ahead in 2025!