Introduction

Temu exploded onto the e-commerce scene with jaw-droppingly low prices, rapid global expansion, and a shopping app that gamifies deals. How can it sell a smartwatch for the price of a latte—or a gadget at a fraction of what you’re used to seeing elsewhere? Independent research shows Temu often prices items ~40% lower on average than matching listings on established marketplaces, with some items discounted far more. Consumers love the savings but wonder: what’s the catch?

This investigation unpacks Temu’s business model, the 5 price levers that drive those ultra-low tags, the quality and safety reality, and the hidden costs shoppers rarely see. It’s current as of August 17, 2025, reflecting ongoing regulatory and logistics changes that affect pricing and shipping.

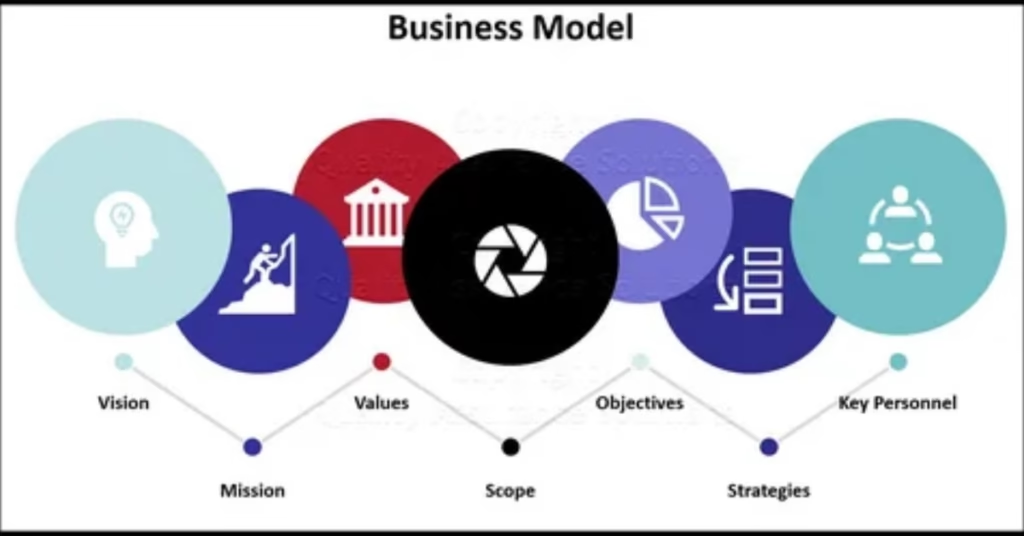

Temu’s Business Model Explained

Direct-from-manufacturer sourcing

Temu connects shoppers straight to factories and workshops, trimming layers of distributors and importers. That structural shortcut lowers costs from day one.

Parent company scale: PDD Holdings

Temu is backed by PDD Holdings (PDD), a giant with vast procurement power, data infrastructure, and logistics know-how—all of which compress operating costs and enable aggressive pricing at scale. (See PDD’s 20-F filings for the official, up-to-date business overview and scale.)

The C2M (Consumer-to-Manufacturer) model

C2M pulls real-time demand signals into production planning, reducing overstock and waste. By learning what people want (and at what price), suppliers can make short runs quickly and cheaply, then scale winners—another downward force on prices.

The 5 Key Factors Behind Rock-Bottom Prices

| # | Factor | What It Means | How It Lowers Price |

| 1 | Elimination of middlemen | Factory → app → you | Cuts distributor margins and retail markups |

| 2 | Platform subsidies & promos | Coupons, games, flash deals | Offsets item cost with marketing subsidies |

| 3 | Lower spec/quality options | Cheaper materials & simpler QA | Reduces bill of materials and labor time |

| 4 | Bulk & optimized shipping | Consolidation, line-haul, local handoff | Lowers per-unit freight cost |

| 5 | Strategic loss leaders | Sell some items below cost to acquire users | Boosts app growth and lifetime value |

Temu has spent heavily to make #2 and #5 work—think Super Bowl ads, billions in digital marketing, and app-wide giveaways. Those subsidies show up as savings in your cart (even if the platform eats short-term losses).

Shipping costs are suppressed by consolidation (bundling many orders), long-haul air/sea legs, and local last-mile partners. Historically, the U.S. de minimis rule (duty-free imports under $800) further reduced landed costs—but new policy moves are reshaping that advantage and prompting a shift to more U.S. fulfillment.

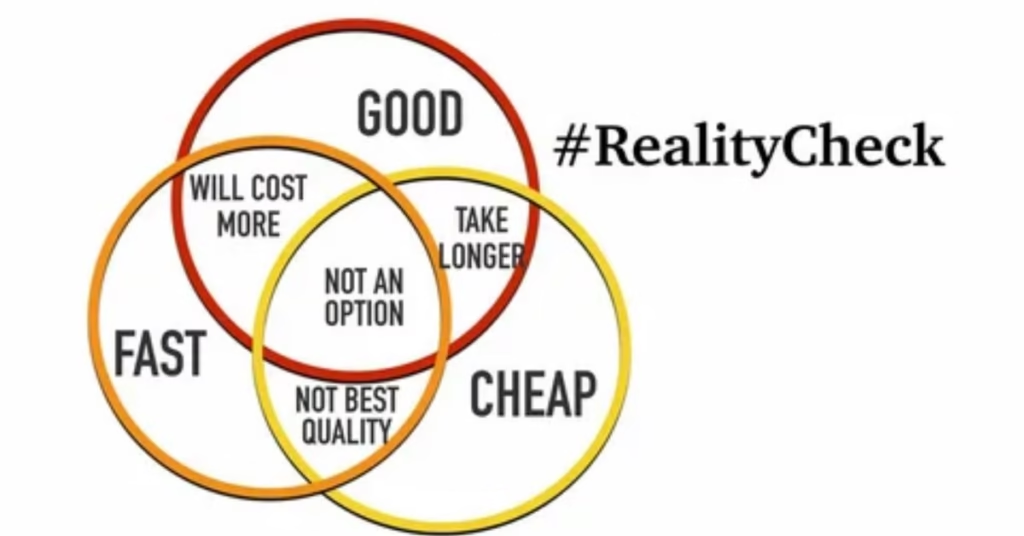

Product Quality Reality Check

Independent testing snapshots

Consumer safety groups and media investigations have flagged security flaws (e.g., cheap smart devices) and safety issues in some categories (especially toys and apparel). That doesn’t mean everything is unsafe—but variance is high, and quality screens can be weaker with third-party marketplaces.

Customer review patterns

Because many listings are factory-direct, quality ranges from surprisingly decent to disappointing. Reviews often cite inconsistent sizing/finishes but acceptable price-to-utility. Translation: you get what you pay for, and sometimes a bit more—sometimes less.

Price-to-quality ratio vs. big marketplaces

Comparative studies find broad savings (~40% average), but “equivalent” products aren’t always apples-to-apples on materials, certification, or warranty. Evaluate specs, safety notes, and after-sales support, not just the sticker price.

Common Concerns Addressed (FAQs-style inside the report)

Is it a scam?

Temu is a legitimate platform operated by a publicly listed parent. But like any large marketplace, listing quality and seller reliability vary—so buyer diligence matters.

Is it a Chinese company?

Temu is operated by PDD Holdings, a Cayman-incorporated, China-rooted tech group with international operations.

How can shipping be free?

Free/low shipping is enabled by consolidation, bulk line-haul, local last mile partners, and historically by de minimis duty treatment for small parcels; current U.S. policy changes are pushing a pivot to domestic warehousing, which may affect prices and assortments.

Are the products safe?

Safety varies by seller and category. The EU has designated Temu a VLOP under the Digital Services Act, increasing scrutiny of product safety and illegal items. Always check safety labels, certifications, and recall notices.

The Hidden Costs of Ultra-Cheap Products

Environmental impact

Ultra-fast commerce can encourage overconsumption, short product lifecycles, and cross-border freight emissions. C2M reduces some waste, but the sheer volume of low-value shipments still has a footprint.

Labor practices & compliance risk

Marketplace oversight is improving, but regulators continue probing compliance and safety. Enforcement actions and pledges (e.g., safety programs) signal ongoing risk management rather than a solved problem.

Product longevity & waste

When items are built to the lowest spec, failure rates rise—and so does waste. A bargain that breaks quickly costs more over time than a moderately priced, durable item.

Conclusion

Temu’s low prices are real and stem from factory-direct sourcing, C2M, massive subsidies/ads, and logistics optimization—historically turbocharged by duty-free small parcels. The trade-off: quality variability, potential safety gaps on third-party listings, and policy risk that can alter shipping speed and prices. For more tech tips and app reviews, check out Fletchapp.com to stay ahead in the world of technology!

Follow us on Instagram and Twitter/X!

Pro tips for smart Temu shopping

- Prioritize listings with detailed specs, real photos, and thousands of verified reviews.

- For electronics, check certifications and recent independent tests; avoid “no-name” devices with vague safety details.

- Use price history (when available), but weigh warranty, return policy, and support.

- For kids’ items and cosmetics, favor known-safe materials, check recall pages, and skip anything with missing safety info.

- Expect longer lead times on non-local items; consider local-stock filters when speed matters.

FAQs:

- Are products safe and compliant?

Many are, many aren’t. The EU now treats Temu as a Very Large Online Platform with stricter responsibilities. Shoppers should check warnings/recalls, certifications, and reviews—especially for kids’ products and electronics. - Why are prices “up to 80% lower”?

Because of factory-direct sourcing, platform subsidies, and lean logistics. Independent analyses put the average gap near 40%, but specific items can swing far wider—both higher and lower. - Is Temu losing money on some orders?

Often yes. Analysts and trade press have documented loss-leader strategies and heavy ad spend to acquire users and sellers quickly. - Has anything changed in 2025 that could affect prices?

Yes. U.S. de minimis and tariff changes are pushing a shift from cross-border mail to U.S. warehousing, which can trim assortments and nudge prices up in some categories. - Is shipping really free? What’s the catch?

“Free” is often subsidized. Temu consolidates shipments and uses long-haul routes with cheap last-mile handoff. Policy changes may reduce pure cross-border mail in favor of domestic fulfillment. - What’s the quality like vs. higher-priced marketplaces?

Variable. Some items deliver solid value; others cut corners on materials or finish. Read reviews closely and favor listings with clear specs and brand accountability.

7. Is Temu “Chinese”? Who owns it?

Temu is operated by PDD Holdings, a Cayman-incorporated company with China-rooted operations and a U.S. listing regime.